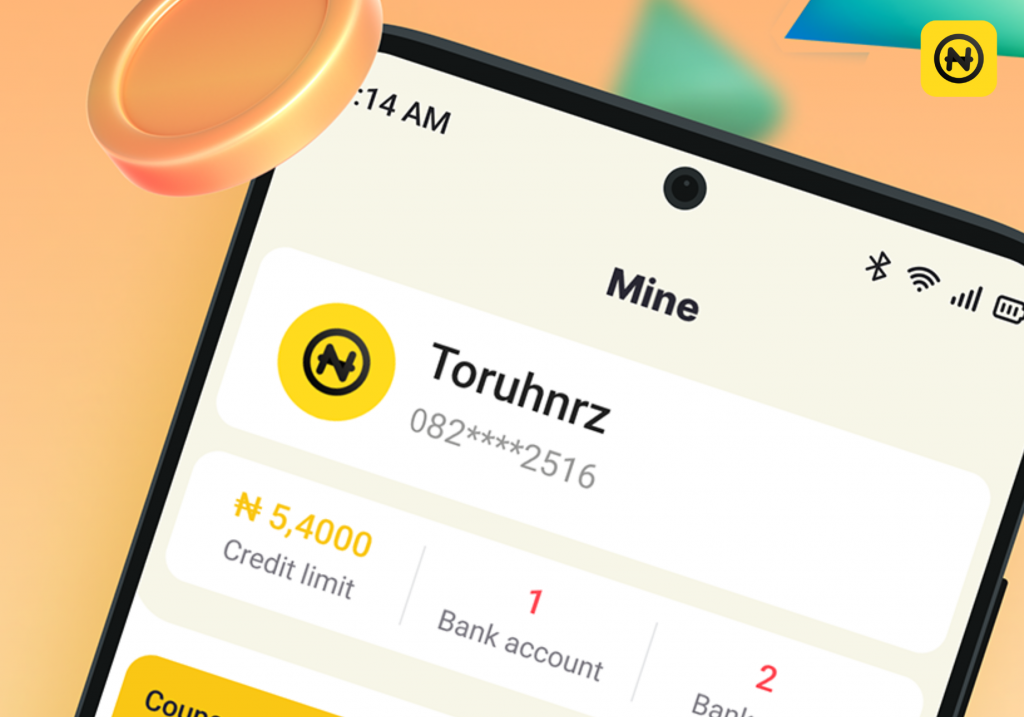

Lcredit Max: Revolutionizing credit access in Nigeria

In a country where access to credit is often limited and complicated, Lcredit Max emerges as an innovative solution transforming the financial landscape in Nigeria. This mobile application offers users the ability to obtain loans quickly, securely, and conveniently, making it an invaluable tool for millions of Nigerians.

What is Lcredit Max?

Lcredi Max is a mobile loan application designed to facilitate credit access for individuals and small businesses in Nigeria. The app focuses on simplicity and accessibility, allowing users to apply for and receive loans directly from their mobile devices without the need to visit a bank or complete extensive paperwork.

Key features of Lcredit Max

-

Quick and easy application process:

- Users can register and apply for a loan within minutes. The application process is intuitive and designed to minimize the time and effort required.

- Users can register and apply for a loan within minutes. The application process is intuitive and designed to minimize the time and effort required.

-

Personalized loans:

-

Lcredit Max offers personalized loans based on the user’s financial profile, credit history, and repayment capacity. This ensures that users receive loan offers tailored to their needs and repayment abilities.

-

Lcredit Max offers personalized loans based on the user’s financial profile, credit history, and repayment capacity. This ensures that users receive loan offers tailored to their needs and repayment abilities.

-

Fast disbursements:

- Once the application is approved, the loan is quickly disbursed into the user’s bank account, usually within hours. This speed is crucial for those who need funds urgently.

- Once the application is approved, the loan is quickly disbursed into the user’s bank account, usually within hours. This speed is crucial for those who need funds urgently.

-

Transparency in rates and terms:

- The app is transparent regarding interest rates and loan terms, avoiding hidden charges and unpleasant surprises. Users can clearly see how much they will need to pay and within what timeframe.

- The app is transparent regarding interest rates and loan terms, avoiding hidden charges and unpleasant surprises. Users can clearly see how much they will need to pay and within what timeframe.

-

Data security:

- Lcredi Max uses advanced encryption technology to protect users personal and financial information, ensuring the security and privacy of their data.

Benefits of Lcredit Max for users

-

Improved credit access:

- In an environment where many people struggle to obtain credit due to lack of credit history or banking bureaucracy, Lcredi Max offers an accessible and efficient alternative.

- In an environment where many people struggle to obtain credit due to lack of credit history or banking bureaucracy, Lcredi Max offers an accessible and efficient alternative.

-

Convenience:

- The ability to apply for a loan from anywhere at any time eliminates the need to physically visit a bank branch, saving time and effort.

- The ability to apply for a loan from anywhere at any time eliminates the need to physically visit a bank branch, saving time and effort.

-

Financial inclusion:

-

Lcredi Max is helping to close the financial inclusion gap in Nigeria, allowing more people and small businesses to access the financial services they need to grow and prosper.

-

Lcredi Max is helping to close the financial inclusion gap in Nigeria, allowing more people and small businesses to access the financial services they need to grow and prosper.

-

Financial education:

- In addition to providing loans, Lcredi Max also offers educational resources to help users better understand financial management, saving, and long-term economic planning.

Impact of Lcredit Max on Nigeria’s financial sector

-

Economic stimulation:

- By facilitating access to credit, Lcredit Max contributes to economic growth, allowing more people to invest in businesses, education, and personal improvements.

- By facilitating access to credit, Lcredit Max contributes to economic growth, allowing more people to invest in businesses, education, and personal improvements.

-

Competition and innovation:

- The entry of Lcredi Max into the market has incentivized other financial institutions to improve their services and adopt more advanced technologies to stay competitive.

- The entry of Lcredi Max into the market has incentivized other financial institutions to improve their services and adopt more advanced technologies to stay competitive.

-

Credit history improvement:

- By granting loans and reporting payments to credit agencies, Lcredi Max helps users build and improve their credit history, opening up more financial opportunities in the future.

Challenges and Considerations

-

Interest rates:

- Although Lcredi Max offers transparency in its interest rates, it is important for users to fully understand the associated costs and ensure they can manage the payments.

-

Debt risk:

- As with any loan, there is a risk of over-indebtedness. It is crucial for users to be aware of their repayment capacity and use credit responsibly.

-

Security and privacy:

- Despite the security measures in place, users should always be vigilant about potential fraud threats and ensure they protect their devices and personal data.

Lcredi Max is playing a crucial role in transforming access to credit in Nigeria. With its focus on convenience, transparency, and financial inclusion, this application is empowering millions of Nigerians to take control of their finances and improve their quality of life. However, it is essential for users to understand the responsibilities that come with using credit and to use these tools prudently and strategically.

Leave a Reply